What Are Closing Costs?

Closing costs in Rancho Cucamonga are a sum of mandatory fees and charges that have to be paid to different stakeholders on the closing or settlement day. These are paid in addition to the net property amount and the mortgage loan amount.

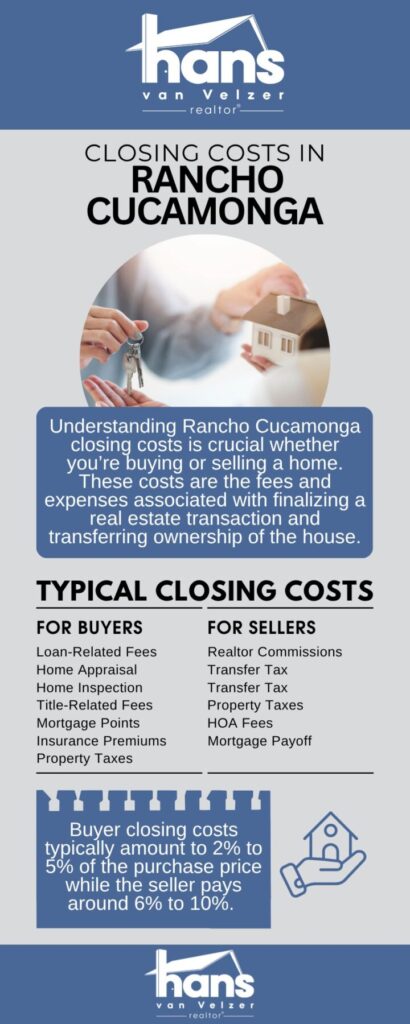

Understanding Rancho Cucamonga closing costs is important whether you’re buying or selling a home. These costs are the fees and expenses that come with finalizing a real estate transaction and transferring the ownership of the house.

Both buyers and sellers pay closing costs in some form or another. Buyer closing costs typically amount to 2% to 5% of the purchase price while the seller pays around 6% to 10%.

In this guide, we’ll break down everything you need to know about closing costs in Rancho Cucamonga to help avoid surprises at the closing table.

Buyer's Closing Costs in Rancho Cucamonga

For homebuyers in Rancho Cucamonga, real estate fees related to the closing or the settlement are paid in earnest money upon reaching the mutual acceptance of the home purchase. This typically amounts to 1% to 3% of the home price.

This deposit is then subtracted from the buyer’s closing costs, reducing the total amount due at closing. Below are some of the common closing costs paid for by the buyer in Rancho Cucamonga:

Loan-Related Fees

Most lenders charge an origination fee for processing the buyer’s loan and may charge application and credit-check fees as well.

Home Appraisal

Mortgage lenders also require home appraisals to ensure that the property is worth what they’re loaning the buyer. Home appraisals typically cost around $300 or $400.

Home Inspection

Home inspections are not mandatory, but most buyers prefer to have a professional examine the property and determine whether it has any major damage or problems.

Title-Related Fees

A title search involves reviewing property records to confirm that there are no liens or encumbrances on the home’s title. Title insurance is designed to protect the buyer in case someone else has any claims on the property.

Mortgage Points

This is optional for buyers who want to lower the interest rate on their mortgage. While this can be tempting in a high-interest rate environment, mortgage points will drive up your closing costs, although it can save you money over the life of your mortgage.

Property Taxes and Insurance Premiums

A prepayment for property taxes and homeowners’ insurance premiums may be required, and the funds are typically held in escrow and paid out as needed.

Seller's Closing Costs in Rancho Cucamonga

In Rancho Cucamonga, the seller pays around 6% to 10% of the home’s purchase price. Below are some of the common fees and costs that a Rancho Cucamonga seller may cover:

Realtor Commissions

Real estate agent commissions are often the biggest expense for sellers. Each agent typically earns between 2.5% and 3% of the home’s sale price.

Transfer Tax

Real estate transfer taxes cover the transfer of ownership of the property. In Rancho Cucamonga, property transfer taxes cost $1.10 for every $1,000 in home value.

Title Insurance

Title insurance provides protection for the seller if issues arise with the title of the property. This can cost anywhere from a few hundred dollars to as much as $1,000.

Property Taxes and HOA Fees

The seller’s property taxes and HOA dues (if applicable) must be up to date up until the closing day.

Mortgage Payoff

If the seller still has a mortgage on the home being sold, that will have to be paid off, typically by transferring funds from the sale proceeds. The seller’s bank will likely charge a nominal wire transfer fee.

Rancho Cucamonga Real Estate Market Context

As of June 2025, the Rancho Cucamonga, CA, real estate market is very competitive, with homes receiving two offers on average and selling in around 28 days. There were 100 homes sold, up from 93 last year.

The median sale price of a home in Rancho Cucamonga, CA, is $812,000, reflecting an increase of 0.2% compared to the previous year. The median sale price per square foot is $442.

Tips for Managing Closing Costs

Closing costs are not set in stone; both the buyer and the seller can negotiate to help lower their expenses.

For sellers, agents’ commission fees are often negotiable. On high-priced homes, even a small commission discount can result in thousands of dollars in savings.

Buyers can check if they’re eligible for any government-sponsored assistance programs that can help cover some or all of the closing costs. They can also shop around for mortgage lenders and other service providers that offer the lowest rates.

Conclusion

Whether you’re a buyer or a seller, it is important to understand the closing costs involved in a real estate transaction in Rancho Cucamonga, CA.

If you need assistance, feel free to give me a call today at 714-519-9399 or email me at hans@hansvanvelzer.com to schedule an appointment.

Frequently Asked Questions

What are typical closing costs for buyers in Rancho Cucamonga, CA?

Typical closing costs for buyers in Rancho Cucamonga include loan-related fees, home appraisal, home inspection, title-related fees, mortgage points, and property taxes and insurance premiums.

What is included in the seller's closing costs?

Closing costs for sellers in Rancho Cucamonga include realtor commissions, transfer tax, title insurance, property taxes, HOA fees, and mortgage payoff.

Who pays the property transfer tax in Rancho Cucamonga?

The seller typically pays the property transfer tax in Rancho Cucamonga.

What is the current real estate market like in Rancho Cucamonga?

As of June 2025, the Rancho Cucamonga real estate market is very competitive, with homes receiving two offers on average and selling in around 28 days. The median home sale price is $812,000, reflecting an increase of 0.2% compared to the previous year.

Are closing costs negotiable in Rancho Cucamonga?

Closing costs in Rancho Cucamonga are not set in stone, both the buyer and the seller can negotiate to help lower their expenses.