Buying your first home is one of the most exciting milestones in life — and in sunny Rancho Cucamonga, it can be a dream come true.

With its mountain views, family-friendly neighborhoods, and easy access to both Los Angeles and the Inland Empire, this city offers the best of Southern California living without the sky-high prices of the coast.

But before diving into open houses, it’s important to understand what actually qualifies you as a first-time homebuyer, and what mortgage loans Rancho Cucamonga CA can help make your purchase more affordable.

Defining “First-Time Homebuyer” in California

The 3-Year Rule

In California, the term first-time homebuyer doesn’t necessarily mean you’ve never owned a home in your life. Under federal and state guidelines, you’re considered a first-time buyer if you haven’t owned a primary residence in the last three years.

That means if you sold a home several years ago or only owned an investment property (not your main home), you could still qualify as a first-time buyer today.

Exceptions and Special Cases

There are a few exceptions to the three-year rule. For example, individuals who lost ownership due to divorce or separation may still be eligible.

Additionally, if you’re purchasing in a federally designated targeted area, the first-time buyer rule may be waived altogether — allowing repeat buyers to access certain down payment and loan programs.

Primary Residence Requirement

All first-time homebuyer programs in California share one non-negotiable rule: the home must be your primary residence.

You can’t use these programs to buy a vacation home or investment property. You’re expected to live in the home within 60 days of closing and keep it as your main residence for a set period (usually several years).

Key Mortgage Options for Rancho Cucamonga Buyers

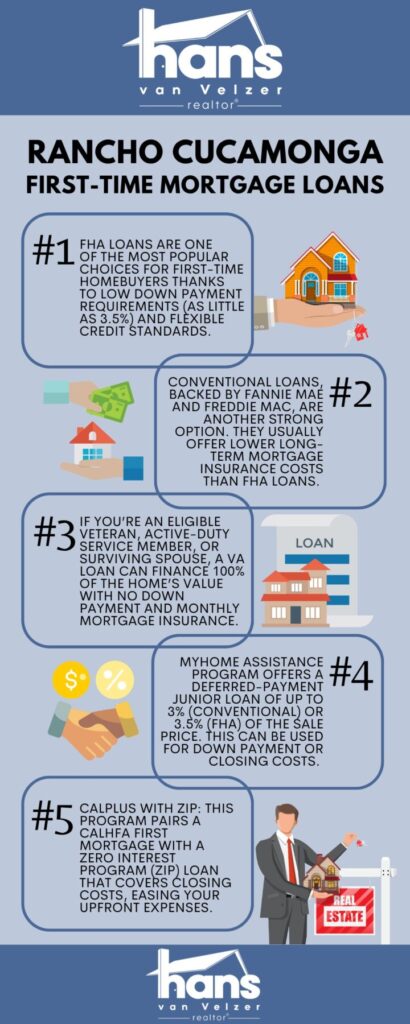

Federal Housing Administration (FHA) Loans

FHA loans are one of the most popular choices for first-time homebuyers thanks to low down payment requirements (as little as 3.5%) and flexible credit standards. They’re ideal if your credit score isn’t perfect or if you have a smaller savings cushion.

Note on limits: In San Bernardino County — which includes Rancho Cucamonga — the 2025 FHA loans Rancho Cucamonga limit for a single-family home typically falls between $644,000 and $672,750, depending on the property’s exact location.

Conventional Loans

Conventional loans, backed by Fannie Mae and Freddie Mac, are another strong option. They usually offer lower long-term mortgage insurance costs than FHA loans.

For first-time buyers, the Conventional 97 program allows a down payment as low as 3%. To qualify, you’ll need solid credit and verifiable income.

Conforming loan limits: For 2025, the conforming Rancho Cucamonga home loans limit for a single-unit property in San Bernardino County is around $806,500 — giving plenty of room for buyers in Rancho Cucamonga’s mid-range market.

U.S. Department of Veterans Affairs (VA) Loans

If you’re an eligible veteran, active-duty service member, or surviving spouse, a VA loan is hard to beat. You can finance 100% of the home’s value with no down payment, no monthly mortgage insurance, and competitive interest rates.

USDA Loans

While Rancho Cucamonga itself doesn’t fall within the USDA’s “rural” boundaries, some nearby areas on the outskirts of San Bernardino County may qualify. USDA loans offer zero-down financing for buyers purchasing in eligible rural zones.

Top Down Payment & Assistance Programs in California

California Housing Finance Agency (CalHFA) Programs

CalHFA is a state-run agency that helps first-time buyers afford homes through low-interest loans and down payment assistance.

- MyHome Assistance Program: Offers a deferred-payment junior loan of up to 3% (conventional) or 3.5% (FHA) of the purchase price, which can be used toward your down payment or closing costs. You don’t have to repay it until you sell, refinance, or pay off your first mortgage.

- CalPLUS with ZIP: This program pairs a CalHFA first mortgage with a Zero Interest Program (ZIP) loan that covers closing costs, easing your upfront expenses.

Local Rancho Cucamonga and San Bernardino County Programs

Regional programs also exist. For example, Neighborhood Partnership Housing Services (NPHS) has historically offered assistance for Inland Empire buyers — including Rancho Cucamonga residents — through grants and affordable second mortgages.

Mortgage Credit Certificates (MCC)

Mortgage Credit Certificates are a lesser-known but powerful tool. They allow qualified buyers to claim a federal tax credit (up to 20% of annual mortgage interest), effectively increasing your monthly disposable income.

Homebuyer Education Requirement

Most assistance programs require completing an approved homebuyer education course. It’s typically a one-day online class that helps new homeowners understand budgeting, loan terms, and the responsibilities of ownership.

Understanding Costs: Down Payment, Closing Costs, and PMI

Down Payment

When it comes to buying your first home, understanding down payment requirements is key to planning your budget.

For FHA loans, the minimum down payment is 3.5%, making them a popular choice for buyers with limited savings.

Conventional loans typically require a 3% down payment for first-time buyers or 5% for repeat buyers, depending on the program and credit qualifications.

Meanwhile, VA loans—available to eligible veterans, active-duty service members, and certain spouses—offer a 0% down payment option, allowing qualified buyers to finance the entire purchase price without putting any money down.

Estimating Closing Costs

Don’t forget closing costs, which typically range from 3% to 5% of the loan amount. These fees cover the appraisal, title insurance, escrow, and lender origination charges. CalHFA’s ZIP program and local grants can help offset some of these expenses.

Private Mortgage Insurance (PMI)

If you put less than 20% down on a conventional loan, you’ll pay PMI — a monthly premium that protects the lender in case of default. The good news? PMI can be canceled once you’ve built 20% equity.

Mortgage Insurance Premium (MIP)

FHA loans come with their own version called MIP, which includes an upfront payment (usually 1.75% of the loan) and a small annual premium added to your monthly payment.

The First-Time Buyer Process: Step-by-Step Guide

Step 1: Financial Health Check

Start by checking your credit score, reviewing your debts, and calculating your Debt-to-Income (DTI) ratio. Gather pay stubs, W-2s, and bank statements — lenders will need these to verify income.

Step 2: Homebuyer Education

Complete the required homebuyer course if you plan to use CalHFA or another assistance program. It’s educational and often saves you from rookie mistakes.

Step 3: Pre-Approval

Get pre-approved by a CalHFA-approved lender. A pre-approval letter tells sellers you’re serious — and it helps you shop within your true budget.

Step 4: House Hunting in Rancho Cucamonga

Now comes the fun part! Work with a local real estate agent who knows Rancho Cucamonga’s neighborhoods — from the family-friendly Victoria Gardens area to the scenic foothills near Day Creek.

Step 5: Closing the Deal

Once your offer is accepted, the lender will order an appraisal and inspection. After underwriting and final approval, you’ll sign your closing documents and officially get the keys to your first home.

Conclusion

Buying your first home in Rancho Cucamonga, CA, isn’t just about numbers and loan limits — it’s about laying the foundation for your future.

With the right combination of state-backed assistance, smart mortgage choices, and local expertise, homeownership is more attainable than many first-time buyers realize.

If you’d like to explore your home options in Rancho Cucamonga, CA, please give me a call at 714-519-9399 or send me an email at hans@hansvanvelzer.com to schedule an appointment.

Frequently Asked Questions

What is the minimum credit score required for an FHA loan in Rancho Cucamonga?

Generally, 580 is the minimum for a 3.5% down payment. Scores between 500 and 579 may still qualify with a 10% down payment.

Do I have to be a first-time homebuyer to use CalHFA programs?

Most CalHFA programs are designed for first-time buyers, but certain exceptions apply if you’re purchasing in a federally designated targeted area.

How much money do I need saved?

Plan for at least 3%–5% down, plus 3%–5% for closing costs. Assistance programs can help cover part or all of these expenses.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is a rough estimate based on self-reported data. Pre-approval involves full documentation and credit review — it’s what sellers take seriously.

What are the current conforming loan limits in San Bernardino County?

As of 2025, the limit is approximately $806,500 for a single-family home.

Can I use a gifted down payment?

Yes! FHA, VA, and many conventional programs allow gift funds from family members to cover part or all of your down payment.